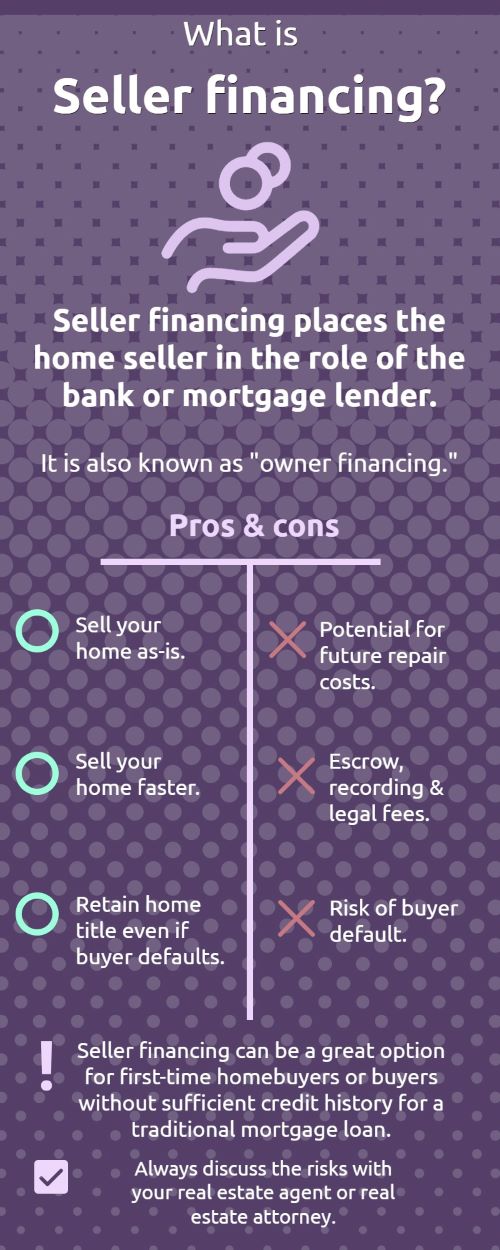

Seller financing is an option for buyers and sellers to work together without a traditional mortgage. Also called owner financing, this type of financing involves the seller providing funding for the home in the form of credit.

Since sellers are often more flexible with financial requirements than banks, this can be an excellent option for a buyer with subpar credit or other financial issues.

Here is some more important information about seller financing arrangements:

How does seller financing work?

In seller financing, the seller acts as the mortgage lender rather than a bank or financial institution. There are typically fewer closing costs involved and different requirements for home appraisals.

Types of seller financing agreements

Different types of agreements are available to fit a wide range of scenarios. The most common types are:

- Land contract.

- Assumable mortgage.

- Lease purchase agreement.

- Land loan.

- Holding a mortgage loan.

Mechanics of seller financing

In a seller financing agreement, both buyer and seller sign a promissory note with the specific terms of the loan. The buyer pays the amount back with an agreed upon amortization schedule, usually with interest. A seller financing deal often offers the short-term option of requiring a balloon payment within the first several years.

Tips to reduce the seller's risk

Just like a bank or mortgage lender, you take a risk when offering a seller financing agreement. If the buyer defaults on payment, you could be subject to serious legal fees. However, there are some steps you can take to serious legal fees. However, there are some steps you can take to reduce your risk as the lender and seller:

- Require at least a 10% down payment.

- Use a complete loan application just like a traditional lender would require.

- Work with a real estate attorney & knowledgeable real estate agent for help during the process.

Is seller financing a good way to sell your home? If you've paid off your existing mortgage, it can be a great way to make a sale in a tough market. However, many sellers would rather not take the risks. Ultimately, you'll have to weigh the pros and cons in your specific situation.

About the Author

Carol McCullough Relocation Certified

As a Fairfield resident with a family commuting daily on Metro North, and our children graduating from Fairfield public schools, I look forward to sharing many of the great attractions in a wonderful community and county! Over the past 18 years with Berkshire Hathaway Home Services New England Properties, I have helped hundreds of buyers and sellers compete their home search and close on the sale of their property. As a Certified Relocation Specialist, my production results rank in the top 4% nationally while delivering exceptional customer service to my clients and their welcomed referrals. Real Estate is one of the most exciting investments you can make. It should be a fun and rewarding experience. Confident with your home marketing decisions and comfortable with the home marketing process is my commitment to you! I am excited to share several new marketing strategies successfully implemented in Southern Fairfield County! Regardless if you are looking to buy, or about to list your current home, you will soon BE AT HOME when working with Carol! *Connecticut Magazine 2022 Award Winner- 12th consecutive year scoring highest in overall customer satisfaction.